sales tax on food in chattanooga tn

You can print a 925. In the state of Tennessee sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

If a food truck or other mobile vendor makes Tennessee sales at different temporary locations in Tennessee the vendor should.

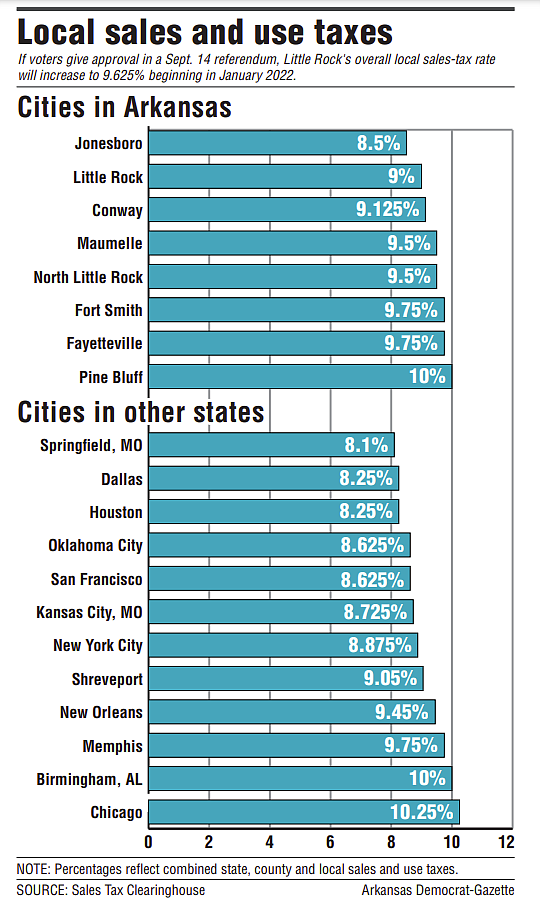

. The minimum combined 2022 sales tax rate for Chattanooga Tennessee is. The sales tax is comprised of two parts a state portion and a local. 31 rows With local taxes the total sales tax rate is between 8500 and 9750.

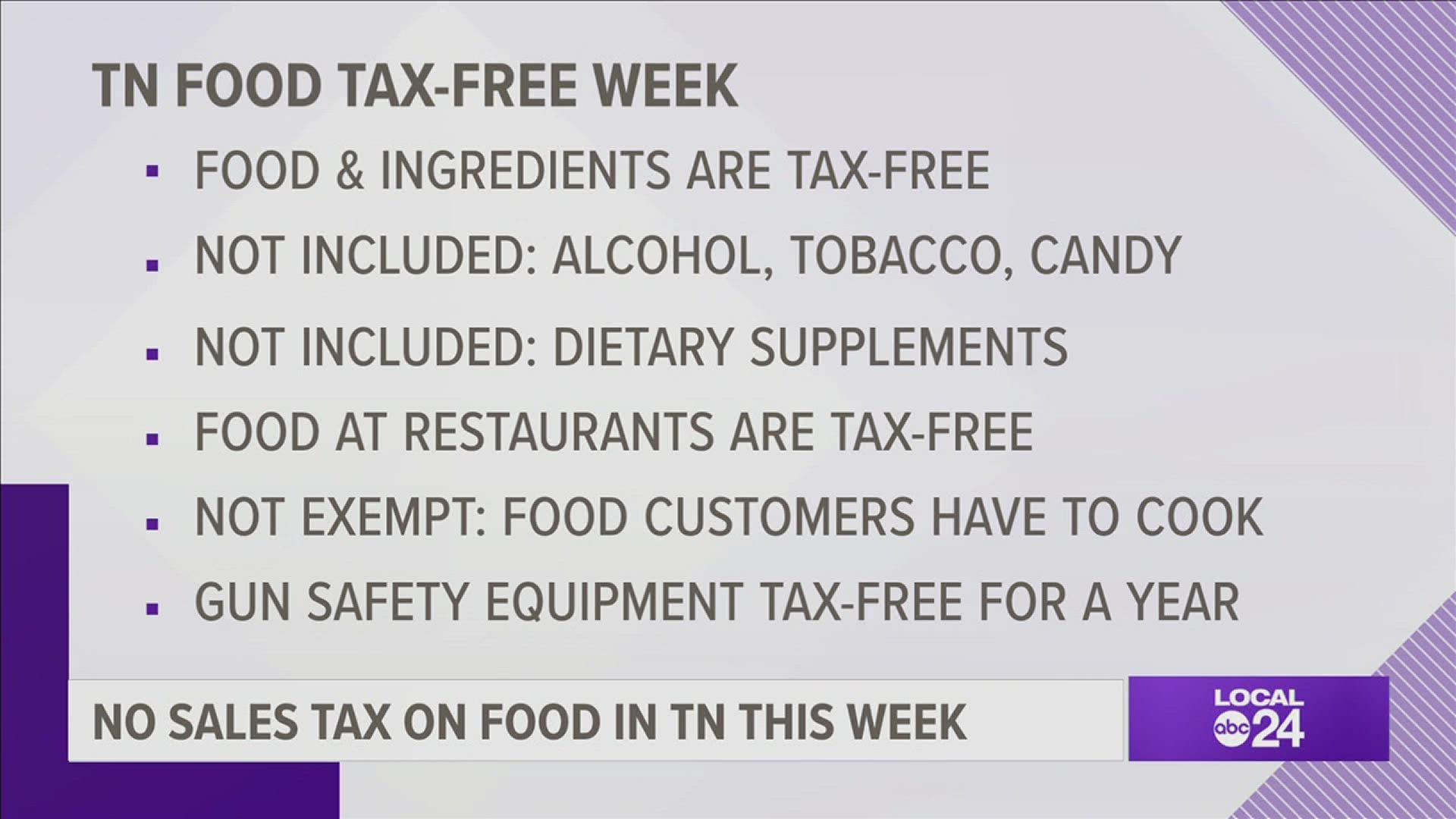

Lee Proposes Suspension of Grocery Sales Tax in Tennessee State tax would be withheld for 30 days. This territory is located in Chattanooga TN and surrounding areas including Cleveland TN andSee this and similar jobs on LinkedIn. The state sales tax holiday on food and food ingredients begins August 1 and lasts the whole month.

During the period beginning at 1201 am on Monday August 1 2022 and ending. Tennessee has recent rate. See home details for Noa St and find similar homes for sale now in Chattanooga TN on Trulia.

There is no applicable city tax or special tax. Food City Governor Bill Lee Grocery inflation local food taxes. Homes for Sale.

The 925 sales tax rate in Chattanooga consists of 7 Tennessee state sales tax and 225 Hamilton County sales tax. Tennessee cut its sales tax on food to 4 from 5 in 2017. Homes for Sale.

Several examples of of items that exempt from Tennessee. For example lets say that you want to purchase a new car for 60000 you. Chattanooga is located within Hamilton.

The Tennessee sales tax rate is 7 as of 2022 with some cities and counties adding a local sales tax on top of the TN state sales tax. Chattanooga residents ready for sales tax holidays. Food in Tennesse is taxed at 5000 plus any local taxes.

31 rows Chattanooga TN Sales Tax Rate. Property Taxes and Assessment. The Tennessee state sales tax rate is currently.

This is the total of state and county sales tax rates. The average cumulative sales tax rate in Chattanooga Tennessee is 925. This includes the rates on the state county city and special levels.

You can calculate the sales tax in Tennessee by multiplying the final purchase price by 07. The December 2020 total local sales tax rate was also 9250. The Tennessee sales tax rate is currently.

Food in Tennesse is taxed at 5000 plus any local taxes. SUT-20 - Food Trucks - Sales Tax Reporting. The current total local sales tax rate in Chattanooga TN is 9250.

The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. See home details for 737 Sylvan Ave and find similar homes for sale now in Chattanooga TN on Trulia. Tennessee Sales Tax Help Hotlines.

With extra federal stimulus funds Tennessee tax revenues grew more than expected during the pandemic and. The December 2020 total local sales tax rate was also 9250.

/cloudfront-us-east-1.images.arcpublishing.com/gray/DGDTWA76IVAQHEX5KGFPCU3FXQ.jpg)

Three Sales Tax Holidays Coming Soon In Tennessee

Tn Sales Tax Holiday Save Money On Groceries Guns School Supplies

Sales Tax On Grocery Items Taxjar

Jackson Tennessee Tennessee Restaurants Sales Tax Holiday

Tn Has Its First Ever Tax Free Week On Food Localmemphis Com

Asia Cafe Chattanooga Restaurant Reviews Photos Phone Number Tripadvisor

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Local Residents Respond To Tennessee Food Tax Holiday Wdef

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Sales Tax On Grocery Items Taxjar

Is Food Taxable In Tennessee Taxjar

Taxing Dilemma Online Shopping And Sales Tax

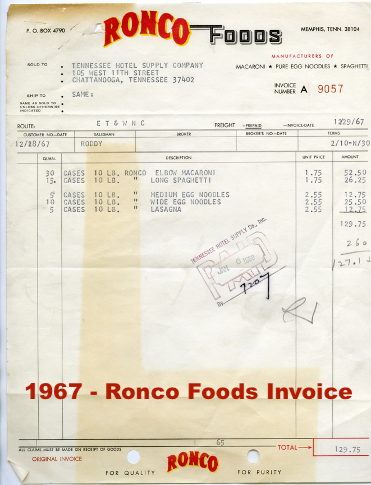

Ths Foodservice Inc History Restaurant Supply Food Storage Chattanooga Tn

Tennessee Cuts Sales Tax On Groceries Raises Tax On Gas Avalara

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities