does tennessee have estate or inheritance tax

Inheritance Tax in Tennessee There are NO Tennessee Inheritance Tax. In 2016 the inheritance tax will be completely repealed.

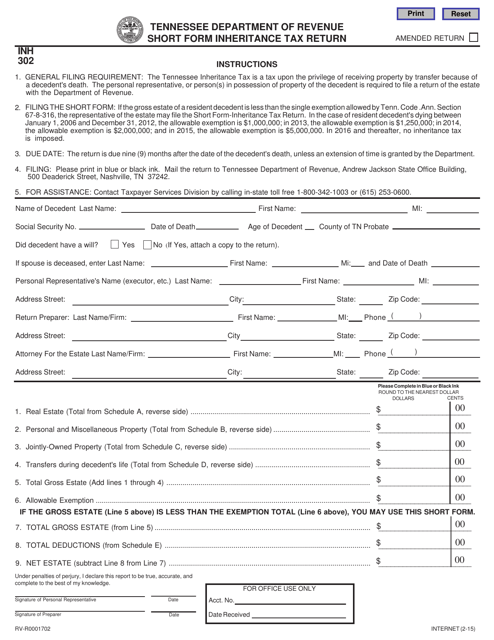

Form Rv R0001702 Inh302 Download Fillable Pdf Or Fill Online State Inheritance Tax Return Short Form Tennessee Templateroller

Tennessee is an inheritance tax and estate tax-free state.

. As of December 31 2015 the inheritance tax was eliminated in Tennessee. A Guide To Tennessee Inheritance And Estate Taxes For all other estates subject to the inheritance tax. This is great news for residence.

It is one of 38 states with no estate tax. Members of the royal family do not have to pay the 40 levy on. Tennessee is not impose an estate tax.

2 days agoTo that end King Charles wont face the UKs 40 inheritance tax which otherwise would have eaten up about 200 million of his mothers estate. It is one of 38 states with no estate tax. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

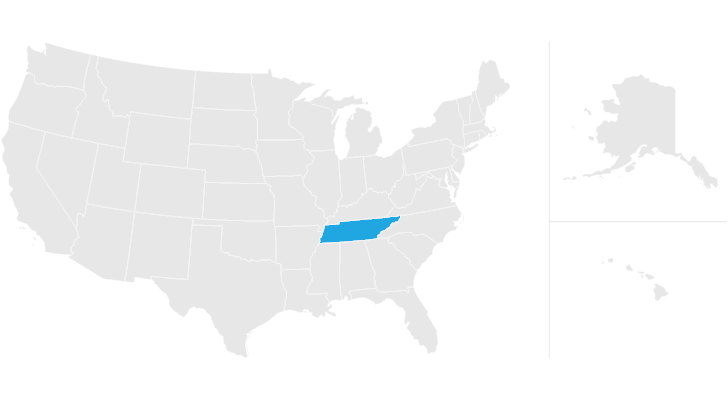

If the total Estate asset property cash etc is over 5430000 it is. In 2012 Tennessee passed a law to phase out the estate or inheritance tax over time. For any estate that is valued under the.

Tennessee does not have an estate tax. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets. Any amount gifted to one person over that limit counts against your lifetime gift tax exemption of 1118 million.

3 hours agoPrince William Charles eldest son inherited the 1 billion Duchy of Cornwall estate from him. Tennessee has no inheritance tax and its estate tax expired in 2016. All inheritance are exempt in the State of Tennessee.

In fact it doesnt matter the size of your estate there will be no state level tax assessed. Tennessee does not have an inheritance tax either. For any decedents who passed away after January 1 2016 the inheritance tax no longer applies to.

Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the. What is the inheritance tax rate in Tennessee. It has no inheritance tax nor does it have.

Tennessee does not have an estate tax. There are NO Tennessee Inheritance Tax. Up to 25 cash back What Tennessee called an inheritance tax was really a state estate taxthat is a tax imposed only when the total value of an estate exceeds a certain value.

Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million. Until that time estate. As Tennessee does not have an income tax all forms of retirement income are untaxed at the state level.

Tennessee Retirement Tax Friendliness Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Tennessee Estate Tax Everything You Need To Know Smartasset

How To Financially Protect Your Unmarried Partner In 2022 How To Plan Estate Planning Common Law Marriage

Illinois Should Repeal The Death Tax

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Tennessee State Tax Guide Kiplinger

A Guide To Tennessee Inheritance And Estate Taxes

Historical Tennessee Tax Policy Information Ballotpedia

Tennessee Estate Tax Everything You Need To Know Smartasset

State Estate And Inheritance Taxes

How Do State And Local Individual Income Taxes Work Tax Policy Center

Do You Need A Tax Id Number When The Trust Grantor Dies Probate When Someone Dies Last Will And Testament

Graceful Aging Legal Services Pllc Estate Planning Attorney Legal Services Estate Planning

Is There A Tennessee State Estate Tax Mendelson Law Firm

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com